Besides being the world’s second largest growing economy, India is also a country that has gone through numerous tangible and intangible changes across all its industries. These changes in fact have fueled the rising economics of the nation. India’s Media and Entertainment industry for one has penned down an incredible growth story ever since its inception.

In the past few years, there has been a revolution of sorts in the manner entertainment is consumed in the country. Notably, some major reforms that were lately introduced by the government became crucially instrumental in keeping the industry’s growth afloat despite of a macroeconomic slowdown. Nevertheless, media continues to be an ever expanding industry with the new members like animation & VFX, digital advertising and gaming contributing significantly towards the overall share of the industry.

According to the findings of a FICCI-KPMG report, in 2011, Indian Media & Entertainment Industry registered a growth of 12% over 2010 and touched the 728 billion mark, while in 2012 the industry grew to INR 820 Billion bringing the overall growth rate to 12.6%. The film Industry in particular has given many reasons to cheer. As more and more films continue to join the elite 100 Crore and 150 Crore clubs, the industry is estimated to grow at 11.6% in 2013.

Going forward, the sector is projected to grow at a compounded annual growth rate (CAGR) of 15.2% to reach INR 1661 Billion by 2017. Moreover, Radio is also anticipated to see a gushing growth post the roll out of Phase 3 licensing (CAGR 16.6% in 2012-2017). The advertising industry however, has suffered the consequences of the global economic slowdown. The advertising revenues fell to 9% in 2012 as against 13% in 2011and 17% in 2010.

Overall Industry Size and Projections:

| Overall Industry Size (INRBillion) | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | Growth In 2012 Over 2011 |

2013P | 2014P | 2015P | 2016P | 2017P | CAGR 2012-2017 |

| TV | 211.0 | 241.0 | 257.0 | 297.0 | 329.0 | 370.1 | 12.5% | 419.9 | 501.4 | 607.4 | 725.0 | 847.6 | 18.0% |

| 160.0 | 172.0 | 175.2 | 192.9 | 208.8 | 224.1 | 7.3% | 241.1 | 261.4 | 285.6 | 311.2 | 340.2 | 8.7% | |

| Films | 92.7 | 104.4 | 89.3 | 83.3 | 92.9 | 112.4 | 21.0% | 122.4 | 138.3 | 153.6 | 171.7 | 193.3 | 11.5% |

| Radio | 7.4 | 8.4 | 8.3 | 10.0 | 11.5 | 12.7 | 10.4% | 14.0 | 15.4 | 18.7 | 22.7 | 27.4 | 16.6% |

| Music | 7.4 | 7.4 | 7.8 | 8.6 | 9.0 | 10.6 | 18.1% | 11.6 | 13.1 | 15.3 | 18.3 | 22.5 | 16.2% |

| OOH | 14.0 | 16.1 | 13.7 | 16.5 | 17.8 | 18.2 | 2.4% | 19.3 | 21.1 | 23.0 | 25.0 | 27.3 | 8.4% |

| Animation | 14.0 | 17.5 | 20.1 | 23.6 | 31.0 | 35.3 | 13.9% | 40.6 | 46.9 | 54.2 | 63.1 | 73.5 | 15.8% |

| Gaming | 4.0 | 7.0 | 8.0 | 10.0 | 13.0 | 15.3 | 17.7 | 20.1 | 23.8 | 30.9 | 36.2 | 42.1 | 22.4% |

| DigitalAdv | 4.0 | 6.0 | 8.0 | 10.0 | 15.4 | 21.7 | 40.9% | 28.3 | 37.1 | 48.9 | 65.1 | 87.2 | 32.1% |

| Total | 514.5 | 579.8 | 587.4 | 651.9 | 728.4 | 820.5 | 12.6% | 917.4 | 1058.5 | 1237.5 | 1438.4 | 1661.1 | 15.2% |

*(Source-FICCI-KPMG Report)

A variety of factors have played a major role in shaping up the rise and the continuous ascent of the Indian Media and Entertainment industry.

- Digitization of Film and TV Distribution: With the advent of digitization in distribution business models across the media sectors have become more sustainable and profitable. These developments have resulted in increased ability to invest in content, marketing and wider releases resulting in greater audience engagement and unprecedented box office success for all movies be it small budget or big budget.

- New Media Revolution: The viral growth of technology coming in the form of wireless connections, 3G connections, the upcoming 4G technology and many smart and cheap devices has increased the levels of audience engagement like never before.

- Content Segmentation: Broadcast economics are expected to be bettered with TV Digitization. It is likely to boost investments in production quality, niche and targeted genres of content/packaging in medium term. Further, Phase 3 licensing and anticipated provisions for permitting multiple frequencies in a city are expected to propel investments in differentiated content for Radio sector.

- Strong Presence of Regional Markets: As Regional markets witness a steady increase in advertising revenues and offer greater insulation from economic slowdown than the metros, they are emerging as the hotspots for the film and the advertising industry alike. Number of film studios like Reliance Big Pictures, Disney UTV Motion Pictures and Eros international are increasingly investing in the regional spaces.

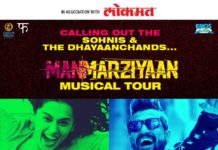

- The Changing Game of Advertising: With the presence of innumerable promotional platforms, Brands and Films are growing keen upon connecting with their audiences/consumers through ‘experiences’ instead of plain advertising. Consequently, activation events like Live Music Shows and Festivals have pumped up the revenues in the OOH (Out of Home) advertising sector.